An Inside Look into CapIQīeing an international database covering over 99% of the global market capitalization, it enables users to access global financial data beneficial for investment bankers, portfolio managers, and analysts. This shows the dispersity of S&P's service, as it can vary from $5,000 per user to over $18,000 per user.

A 5-user Investment Banking firm paid $55,000 annually.An 8-user CPA firm paid $63,000 per year.A 4-user Private Equity firm paid $75,000 annually.A 400-user Valuation Firm paid $600,000 per year.A 25-user CPA firm paid $125,000 annually.

While having upwards of hundreds of thousands of subscribers, CapIQ is slightly less costly than some of its counterparts, causing them to be a popular choice for many investment banking students and users.įor instance, Tangify's research finds that although CapIQ's pricing is not published, data from a few of S&P's clients include that: For instance, it is typically expected for college students to receive access to an account as part of their tuition. Compared to its competitors, like Bloomberg, which have about 33% market share compared to S&P's 6%, their pricing varies per customer.īased on their customers' needs and requested features, the pricing depends on the type of institution or firm, institution size, regional location, and other factors. These services enable the S&P platform to combine, analyze, and formulate insights from carving through substantial amounts of data which are then integrated into their various desktop solutions.įurthermore, S&P's vast pool of data enables their service to provide broad and deep global coverage, which offers a wide array of market insights to aid their clients' growing analytical and operations requirements.įor additional reference, Fordham University's Industry Research Tutorial has been embedded.Īlthough S&P Capital IQ has not outright placed its cost, industry averages place its subscription at around $30,000.

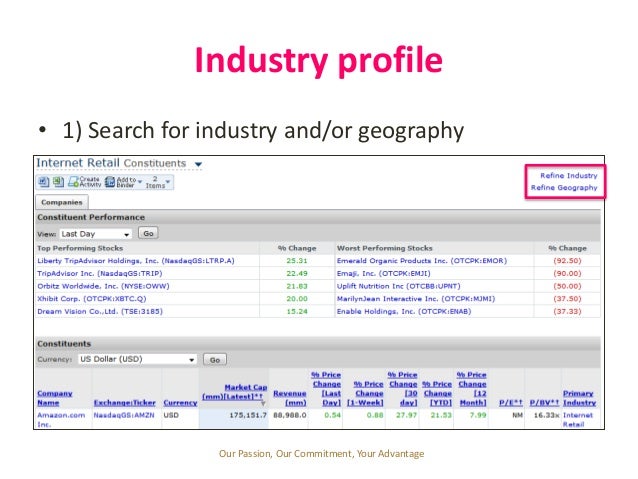

S&P's primary offerings target the off-trading-floor market by providing financial intelligence using their specialized desktop solutions. Thus, it is commonly used for financial modeling purposes, including but not limited to industry and company research, building Excel models, quantitative research, structure and updating slide decks, and even performing general analysis to find comparable companies. Moreover, this product provides up-to-date financial data, market performance comparisons, and insight for investment institutions such as hedge funds.Īdditionally, this concept of arming users with input benefits college students, investors, and even institutional traders. With access to over 150,000 companies worldwide, it can provide market snapshots for publicly-traded companies. It accomplishes such a feat by collecting and analyzing billions of data points annually.Ĭapital IQ reports all this data in company profiles, economic statistics, and executive summaries as a trailblazing pioneer of financial research and services. This platform's web portal provides overall market awareness due to its multi-faceted data provisions ranging from private equity funds to advisory firms. With said information, analysts can perform financial analysis to drive equity research and investment recommendations or help build a comparable company for mergers and acquisitions. Through all the data, research, and news provided through its interface, S&P Capital IQ provides professionals with a plethora of information. However, it is mainly used for financial modeling due to its prevalent involvement in investment banking, asset management, and equity research. Therefore, it is widely known as the research extension of S&P Global, providing market indices, cutting-edge research, and ratings. It began with the sole purpose of providing business analytics for the markets.įive years later, in 2004, it was acquired by McGraw-Hill Financial for over $200 million and later rebranded to S&P Capital IQ in 2016.

CAPITAL IQ PLUG IN SOFTWARE

This software was founded back in 1998 by Steve Turner, Randal Winn, and Neal Goldman. This platform is a highly interactive and resourceful construct that provides value for corporate finance. It is a platform derived from market intelligence data designed by Standard & Poor's, also known as S&P. CapIQ is a shortened abbreviation for S&P Capital IQ.

0 kommentar(er)

0 kommentar(er)